Hi, my name is Rista Aprilia. I am a third-year student at Saxion University of Applied Sciences. I take a major in International Finance and Accounting. This mini system modelling research is my project for the Honorable Program, and I would like to share it with you.

Background

At the beginning of this research, I had a conversation with Prof. Christoph Hinske, and based on this conversation, I realized that technology is already part of our everyday life. We can even see that we use so many forms of technology to support our day-to-day lives. Prof. Dr Ing. Klaus Schwab, in "The Fourth Industrial Revolution: What It Means and How to Respond", mentioned, "We stand on the brink of a technological revolution that will fundamentally alter the way we live, work, and relate to one another." (Schwab, 2017). Digitalization will bring significant changes to all companies. Besides the change in entire core business models, digitalization mainly encompasses support functions such as accounting, controlling and management (Kreher, Sellhorn, & Hess, 2017). Therefore, I came up with a research question: "How might digitalization affect career prospects as an accountant?" This matter becomes more interesting for the accountant since our main tasks are related to numbers, which tools and applications might even do.

I had an opportunity to conduct interviews with four accountant professionals across the sectors to answer my question. With the help of my coach Prof. Christoph Hinske, I explored fundamental approaches to get the best answers to my question in the interviews. These interviews are also part of the data enrichment process since I conduct my interviews based on the previews interviews, ask follow-ups to get a deeper understanding of the topics, and then create a system modelling loop based on the results of all these interviews. So, I will share what I learned in the paragraphs below.

The research

Learning and Improvement

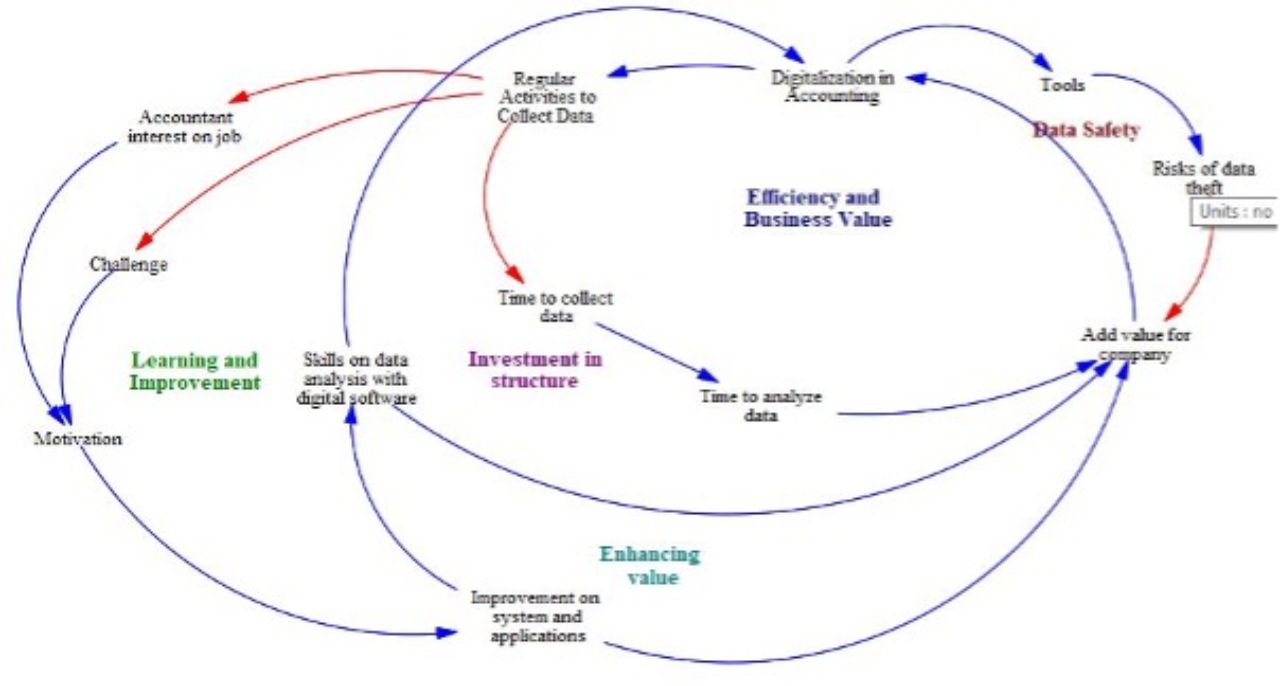

The result of my interviews shows that accountant needs to learn and improve their skills related to system and technology, to support and be able to work optimally in the digitalized era. As shown in the first loop, this statement is because of the digitalized system in the accounting industry; the accountant's job would be more like regular activities, like collecting data. These everyday activities might decrease the interest of the accountant in the job. Meanwhile, the accountant's interest in the position is increasing, which would give the accountant more work motivation. These regular activities might also make the accountant fewer challenges.

Meanwhile, if the accountant feels more challenged in their job, it is more likely that they would get more work motivation. A motivated accountant would be more likely to improve the system and applications, and therefore the accountant can enhance their skills in data analysis with digital software. So, this would benefit the company from their accountant, who has digitalization skills to make more investments in structure. Consequently, it is essential to enhance the interest and challenge of the accountant in their job, but how to improve it still needs further research.

Investment in Structure and Enhancing Value

The second loop explains the reason for this matter. What would be the benefit for the company to invest in this structure? If the accountant can improve the system and applications, this would add more value for the company and enrich the tools and the techniques, so the company's digitalization would work better. This matter leads to the third loop on why motivated accountants to digitalization can enhance the company's value. If the accountant has more skills in data analysis with digital software, they can add more value to the company towards a more digitalized system.

Efficiency and Business Value

Why could digitalization give more value to the company? The fourth loop explained the reason for this matter. With digitalization, the accountant needs to do more regular activities related to collecting data. Therefore, they would process the data further with digital tools to reduce the time to collect the data and, thus, reduce the time to analyze it. This reduction could improve efficiency and, therefore, improve the company's business value. This improvement could motivate the company to increase and enhance the digitalization system.

Data Safety

There is a negative side also that affects digitalization in accounting. This matter leads to the fifth loop, data safety. digitalization requires the accountant to work with more tools. The more tools and data collected, the higher the data safety risk. It increases the risk of data theft, data breach, or other safety risks. The threat could be more severe if the data is related to the company's sensitive information. This matter would eventually reduce the value of the company. The safety risks related to digitalization in accounting still need further research.

Conclusion

To summarise, digitalization affects career prospects as an accountant in several ways. First, accountants need to learn and improve their digital skills. That way, companies would be more confident to invest in digitalization, knowing that their accountants are capable of the digital system. Eventually, the company can enhance their business values by improving the efficiency of the accounting system. Besides the positive effects, accountants and companies also need to be aware of the increased risk to data safety.

This mini-research project made me learn that digitalization could benefit companies and the accountant but also more risks for both sides. So, learning and understanding more digital skills and how to apply it would be more beneficial, rather than being afraid and ignoring them.